1. Economic Insights

Global Economic Outlook

After a period marked by inflationary pressures and fluctuating growth across major economies, global markets are gradually finding their footing. Central banks worldwide have been refining monetary policies to balance growth with inflation control. Investors should closely watch economic indicators such as GDP growth rates, inflation measures, and employment data to gain a comprehensive understanding of market conditions.

Interest Rates and Monetary Policy

Most central banks remain cautious, signaling that interest rates may move gradually upward or hold steady. This has direct implications for borrowing costs and bond yields. Consider reviewing your debt obligations—particularly variable-rate loans—and exploring options to lock in favorable rates when possible.

2. Investment Strategies

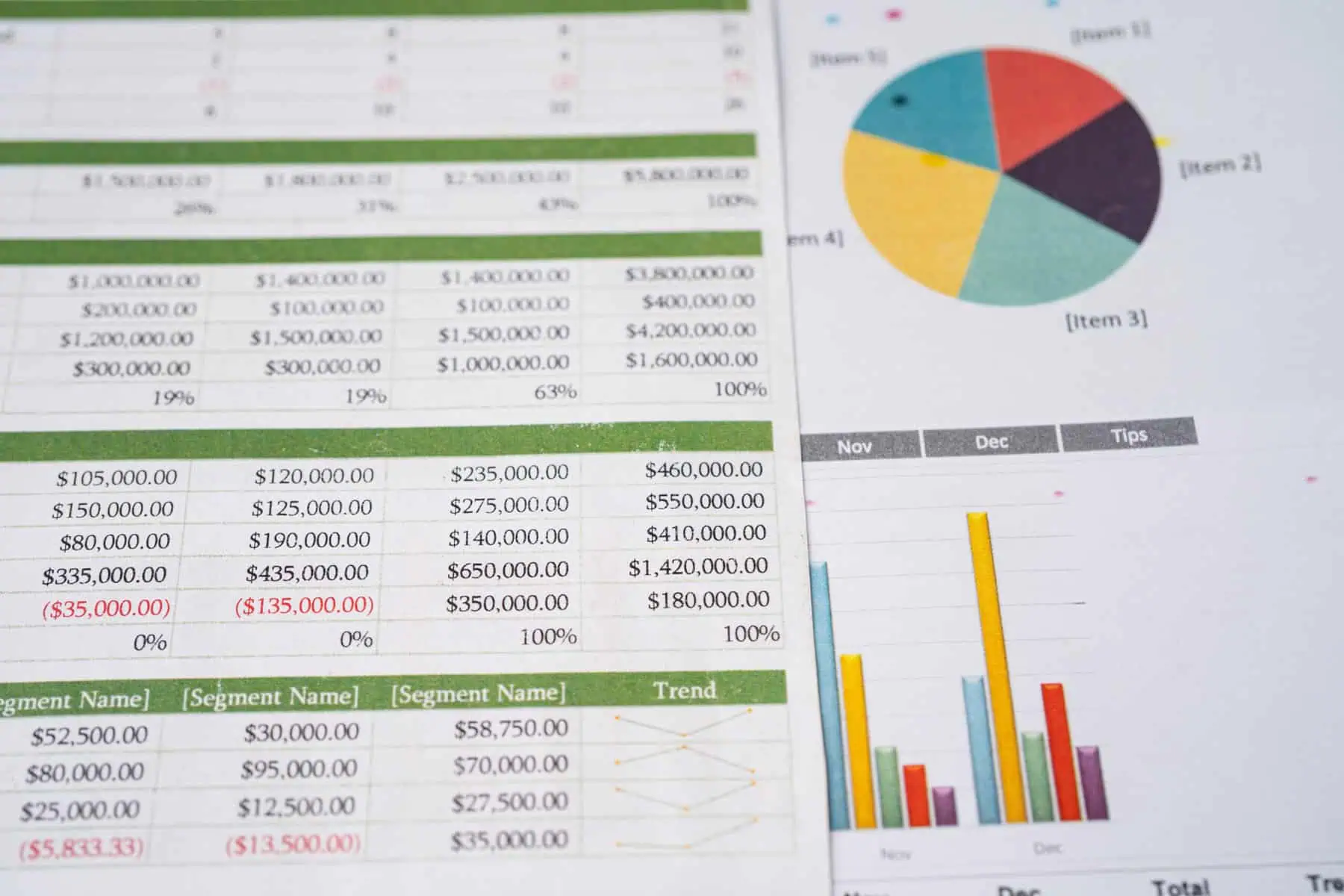

Diversification for Stability

A key principle in uncertain economic climates is diversification. Spreading investments across different asset classes, industries, and geographic regions can help mitigate risk. Balancing traditional asset classes (like equities and bonds) with alternative investments (such as real estate, commodities, or private equity funds) can offer stability amid market volatility.

Market Trends to Watch

- Technology and Innovation

Emerging tech—particularly in AI, green energy, and cybersecurity—continues to attract investors’ attention. Keep an eye on regulatory developments and overall market sentiment when adjusting your portfolio. - Sustainable and ESG Investments

Environmental, Social, and Governance (ESG) considerations are becoming central to many investment strategies. Regulatory scrutiny and consumer demand for ethically aligned portfolios are likely to increase. Incorporating ESG principles may not only add ethical value but can also help manage risk and capture new growth opportunities. - Global Infrastructure

Ongoing infrastructure projects, especially those focusing on sustainability and digitization, present potential long-term growth areas. This can include investments in clean energy networks, data centers, and smart-city technologies.

3. Retirement Planning

Superannuation and Savings

For individuals in regions where superannuation is a primary retirement vehicle, contributing consistently can significantly bolster your nest egg. In March 2024, make it a point to review your contribution levels and explore whether adding voluntary contributions could help you meet or exceed your retirement goals.

Age-Appropriate Asset Allocation

As you get closer to retirement, gradually adjusting your asset allocation toward more conservative investments can help preserve capital. However, the right allocation will depend on your personal risk tolerance and financial circumstances.

Timing Retirement Withdrawals

A strategic withdrawal plan can help maximize your retirement savings. Factor in tax obligations, the sequence of returns, and any potential changes to social security or pension regulations. It’s often beneficial to consult with a financial planner for a withdrawal strategy that maintains income stability while minimizing tax liabilities.

4. Estate Planning

Updating Wills and Trusts

Estate planning is not a “set-and-forget” process. Major life events—like marriage, divorce, or the birth of a child—necessitate updates to wills, trusts, and beneficiary designations. If you haven’t reviewed these documents in the past year, use this period as a reminder to ensure they reflect your current wishes.

Power of Attorney and Healthcare Directives

Consider putting in place or reviewing legal instruments that grant trusted individuals the authority to manage your affairs if you become incapacitated. These documents can cover both financial and healthcare decisions, ensuring your preferences are respected under unforeseen circumstances.

Tax-Efficient Wealth Transfer

Estate taxes, gift taxes, and other levies can significantly erode assets passed on to heirs. Strategies like gifting, charitable giving, and trust structures can help minimize these taxes while preserving wealth for future generations. Be sure to consult with legal and financial professionals to understand the specific regulations in your jurisdiction.

5. Tax Strategies

Proactive Tax Planning

With tax season approaching in many parts of the world, now is the perfect time to gather your financial records and plan. Look for deductions, credits, or offsets you might qualify for, and consider contributing to tax-advantaged accounts like IRAs, 401(k)s, or superannuation funds (depending on your location).

Timing Capital Gains and Losses

If you hold investments subject to capital gains taxes, consider timing your sales to optimize your tax exposure. Offsetting gains with potential losses is a common strategy, but it must be done in compliance with local tax regulations.

Staying Informed on Legislation

Tax regulations can change swiftly, particularly in response to shifting economic policies. Keep abreast of any new legislation or budget updates that might impact your planning—changes to tax brackets, credits, or allowable deductions can substantially alter your liabilities.

6. Personal Finance and Savings Tips

- Emergency Fund

Aim to keep three to six months’ worth of living expenses readily accessible. This fund is crucial to cover unforeseen costs—such as medical emergencies, job loss, or urgent home repairs—without derailing your financial plan. - Budgeting and Debt Management

Regularly reviewing your budget helps you track spending, identify areas for savings, and ensure timely debt repayments. Consider debt consolidation options if you have multiple high-interest loans. - Insurance Coverage

From health and life insurance to property and liability coverage, the right insurance plan provides financial protection. Assess whether your current policies are still adequate in light of changes to your personal or professional circumstances.

7. Looking Ahead

The financial journey in 2024 will require ongoing vigilance, adaptability, and proactive planning. By focusing on diversification, staying informed about economic shifts, and carefully managing taxes and retirement contributions, you can position yourself to grow and protect your wealth. Don’t overlook estate planning and legal considerations—both are integral to a holistic financial strategy.

Seek professional advice when needed. Financial planners, tax specialists, and estate attorneys can offer tailored insights based on your specific goals and circumstances. Here’s to a prosperous March 2024 and beyond!